📉 Bitcoin & Crypto Market Overview – Dec 1, 2025

Bitcoin Performance

- Bitcoin fell nearly 6% in 24 hours, trading below $86,000 (at $85,778), after holding around $91,000 last week.

- November saw Bitcoin lose 16.7% from its recent all-time high of $126,251.

Altcoins Performance

- Ethereum declined 5.85%, trading at $2,814.

- Other major altcoins (XRP, BNB, Solana, Cardano, Tron, Dogecoin, Hyperliquid) fell over 10%, contributing to a total crypto market capitalization drop of 4.82% to $2.94 trillion.

Market Drivers & Analysis

- Leverage flush-out: Over $140 billion wiped from the crypto market due to liquidation of leveraged positions.

- Macro factors: Rising US jobless claims (1.96M) increased expectations of an expansionary Fed, adding downward pressure.

- Technical levels: Bitcoin broke below key support at $89,500; potential short-term retests at $85,500 or $82,000.

- Liquidity tailwinds: A weakening US dollar may provide support for BTC accumulation in uncertain macro conditions.

Expert Commentary

- CoinDCX Research Team: Highlights China’s continued crypto crackdown and stablecoin warnings, contributing to bearish sentiment.

- Delta Exchange Analyst Riya Sehgal: Emphasizes panic-driven liquidations ($300M in leveraged longs wiped out) but notes this is likely a temporary structural flush-out.

- ZebPay Head of Trade Harish Vatnani: Reports over 180,000 traders affected by $539M in liquidations, mostly in long BTC and ETH positions.

Key Takeaway

- Despite the sharp drop, experts suggest this is more of a leverage-driven correction than a fundamental market breakdown. Bitcoin could stabilize and attempt to reclaim the $90,000–$92,000 range once excess leverage clears.

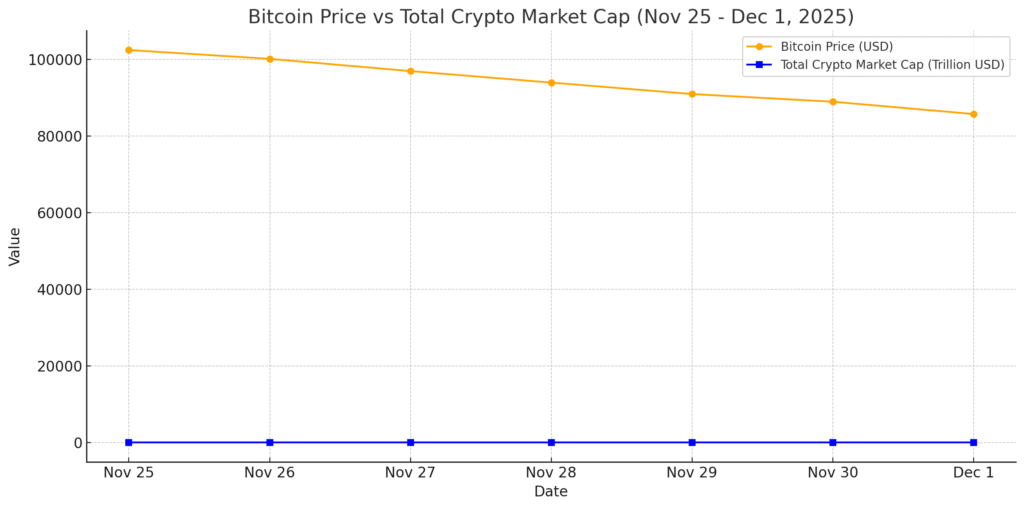

Bitcoin and the broader crypto market have been sliding steadily since late November, with a sharp acceleration on December 1 driven by risk-off sentiment and a leverage flush-out that erased billions in market capitalization. The chart of Bitcoin price vs total crypto market cap from November 25 to December 1 shows both lines trending down together, underlining Bitcoin’s dominant influence on overall crypto valuation.

Bitcoin price and total crypto market capitalization declined steadily in the week leading up to the sharp Dec 1, 2025 sell-off

Chart insight: price and cap move together

The line chart “Bitcoin Price vs Total Crypto Market Cap (Nov 25 –Dec 1, 2025)” visualizes how Bitcoin fell from about 102,500102,500 USD on November 25 to 85,77885,778 USD on December 1, while total crypto market cap dropped from roughly 3.40 trillion USD to 2.94 trillion USD in the same period. The steepest joint decline occurs on December 1, matching reports of a nearly 6% intraday Bitcoin drop and a market-wide sell-off.

Bitcoin price and total crypto market capitalization declined steadily in the week leading up to the sharp Dec 1, 2025 sell-off

This parallel movement reinforces that Bitcoin still acts as the primary driver of crypto market sentiment, with its drawdowns closely mirrored by aggregate capitalization. When leveraged long positions in Bitcoin unwind, liquidity is pulled from the entire ecosystem, dragging altcoins and the total market cap lower in tandem.

What drove the December 1 flush-out

On December 1, Bitcoin slipped below the 86,000 USD mark after trading near 91,000 USD the previous week, while global crypto market capitalization fell to around 2.94 trillion USD. Reporting attributes this move to a combination of heavy liquidations, weakening technical support levels, and a broader risk-off shift among investors.

Bitcoin price and total crypto market capitalization declined steadily in the week leading up to the sharp Dec 1, 2025 sell-off

Analysts quoted in the coverage describe the event as a leverage flush-out rather than a structural breakdown, noting that roughly 140 billion USD in crypto market value was wiped as overextended positions were cleared. This interpretation aligns with the chart’s pattern: a steady week-long slide followed by a sharper capitulation day, a structure often seen in de-leveraging phases that can later pave the way for stabilization if macro conditions improve.

Unlock deeper insights with DF Media

Stay ahead of market momentum with stories that shape tomorrow’s business landscape. Elevate your strategy, accelerate growth, and access perspective that moves industries forward.