The global currency market delivered another wave of movement today as the dollar slides for a second straight session, driven by a surprisingly softer Fed outlook and renewed confidence in the Swiss economy. Investors watched key currency pairs shift sharply as central bank signals shaped expectations for the months ahead.

The greenback remained under pressure after the Federal Reserve delivered a widely expected 25-basis-point rate cut but paired it with a far less hawkish policy tone. Markets had braced for a tougher stance, especially after recent remarks from other central banks hinting at possible rate hikes. Instead, the Fed kept its message balanced, reaffirming flexibility while pointing to a potential rate cut in 2026.

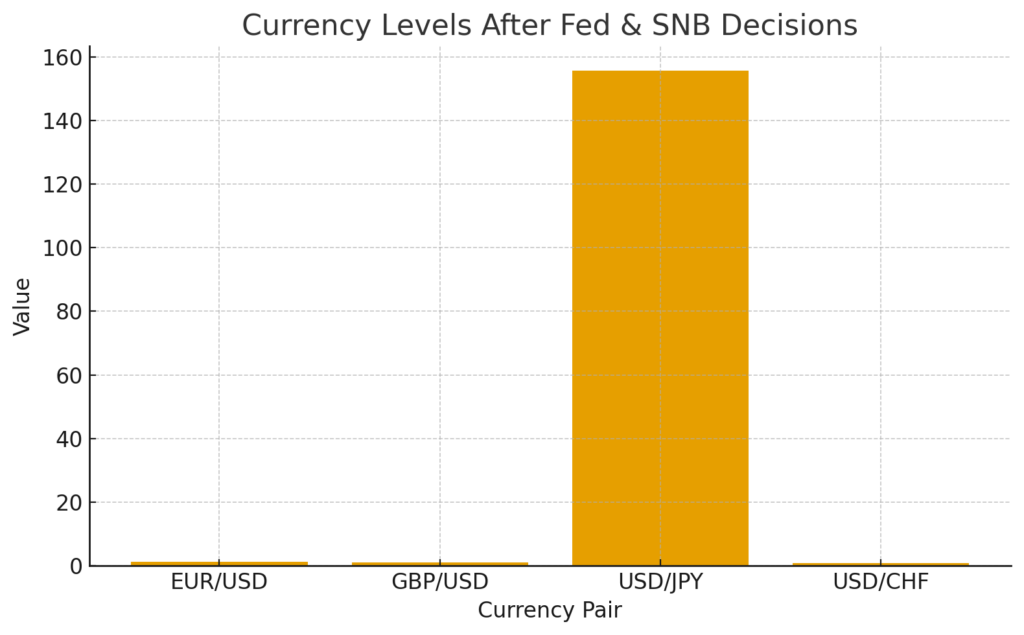

This shift immediately weighed on the dollar, sending the euro to a near two-month high at 1.1713 dollars and keeping sterling firm at 1.1338 dollars. The yen also strengthened, pushing the dollar down to 155.7 yen.

ING’s global head of markets emphasized that Chair Powell avoided locking the central bank into a pause, giving markets a softer landing than expected and pushing the dollar slides narrative further.

Adding to the movement, the Fed announced it would begin purchasing short-dated Treasury bills on December 12, injecting 40 billion dollars into the market to stabilize liquidity. This decision further softened investor appetite for the greenback.

Swiss Franc Surge After SNB Holds Rates Steady

The most notable move outside the U.S. came from Switzerland, where a Swiss franc surge followed the Swiss National Bank’s decision to keep its policy rate unchanged at zero percent. The SNB highlighted improved economic confidence tied to reduced U.S. tariffs on Swiss exports, despite inflation underperforming expectations.

The franc accelerated quickly, pushing the dollar down 0.46 percent to 0.7963 francs, its lowest point in three weeks. The euro also slipped to 0.9331 francs as the Swiss franc surge strengthened the currency across major pairs.

SNB chairman Martin Schlegel noted that while the stronger franc complicates inflation management, the threshold for returning to negative rates remains high.

Aussie Dollar and Crypto Retreat on Risk Concerns

The Australian dollar weakened after November employment numbers revealed the sharpest decline in nine months. Meanwhile, global risk sentiment deteriorated after cloud-computing giant Oracle posted disappointing earnings, renewing concern that AI infrastructure investments may be outpacing returns.

Crypto assets also faced turbulence. Bitcoin briefly dipped below 90,000 dollars before recovering slightly but still ending 2.4 percent lower. Ether dropped more than 4 percent to trade near 3,200 dollars.

According to analysts, October’s excess leverage is still being unwound, making markets hypersensitive to macro signals—even with a softened Fed outlook.