Debt Crisis 2025

Dec 3, 2025 — Global Markets Desk

Two major economic assessments released this week offer a sobering view of where the global economy is heading. Both point to a world where growth is slowing, investment flows are shifting, and the developing nation debt crisis 2025 is becoming one of the most urgent challenges facing policymakers. What is emerging is not just another temporary setback, but a structural turning point that will shape the next decade of global development, trade, and financial stability.

Developing Nation Debt Crisis 2025 Accelerates

A Historic Outflow Raises Red Flags

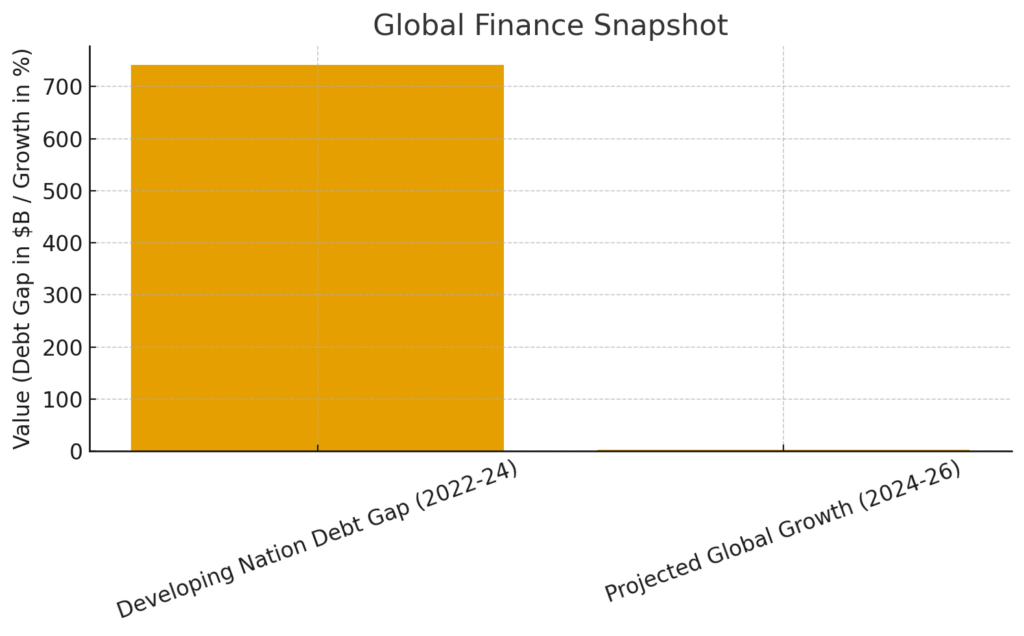

According to a new World Bank report, developing countries paid $741 billion more in principal and interest than they received in fresh financing between 2022 and 2024. That figure represents the largest negative net flow in five decades, and it signals a dramatic reversal in global capital movement.

Historically, emerging markets relied on steady inflows to fund infrastructure, healthcare, education, and industrial growth. But today’s reality looks very different. With global interest rates rising and risk appetite falling, many developing nations are struggling to refinance debt and attract foreign capital.

The World Bank warns that this reversal is not an accident but the result of a structural shift: global liquidity has tightened, foreign investors are more cautious, and external borrowing has become significantly more expensive.

Understanding the Pressure Behind the Outflow

Much of the strain comes from aggressive rate hikes in advanced economies, particularly the U.S. and Europe. When the Federal Reserve and the European Central Bank kept rates high to cool inflation, the cost of borrowing for emerging markets climbed in tandem. Investors moved toward dollar-denominated assets, leaving many developing nations facing higher repayment costs and weaker currency positions.

These countries are also contending with lower export revenues, fragile post-pandemic recovery, and rising geopolitical risks. The combination makes it difficult to build foreign reserves or support local development agendas. Instead of expanding their economies, governments are being forced to cut spending, delay projects, or take on emergency loans at unattractive terms.

This dynamic is at the heart of the developing nation debt crisis 2025, and for many countries, the situation is moving toward a breaking point.

A Growing Push for Debt Restructuring

International institutions are urging governments and lenders to adopt more coordinated debt-restructuring frameworks. Without faster action, the risk of defaults could rise, particularly among frontier markets with limited fiscal space.

Several countries are expected to approach the IMF over the next year, seeking extended maturities, grace periods, or alternative financing. But IMF programs come with conditions that can be politically sensitive, such as subsidy cuts or tax reforms. Balancing economic stability with social welfare will become a major political challenge across Africa, South Asia, and Latin America.

Economists say that unless global rates fall sooner than expected, the developing nation debt crisis 2025 could morph into a broader financial shock — one that affects trade, investment flows, and cross-border lending for years to come.

Global Growth Outlook Turns Soft

UNCTAD Warns of a Prolonged Global Slowdown

Adding to the concerns raised by the World Bank, UNCTAD issued a separate projection showing global economic growth averaging 2.6 percent through 2026. That is markedly below the pre-pandemic average and signals a world entering a more cautious phase of expansion.

UNCTAD describes the current slowdown as both cyclical and structural. While higher interest rates are weighing on near-term growth, deeper issues such as geopolitical fragmentation, slow productivity gains, and declining global trade intensity are reshaping the global economy.

Why Growth Is Losing Momentum Worldwide

UNCTAD highlighted several trends that are expected to keep growth subdued:

1. Tight monetary policy is still working its way through economies.

Even as inflation eases, the lagged impact of higher borrowing costs is suppressing consumer spending and business investment.

2. Supply chains remain fragmented.

Tensions across regions — from Europe to East Asia — have pushed companies to rethink sourcing and production, often resulting in higher costs and slower logistics.

3. Investment sentiment remains weak.

Companies are holding back on major capital expenditure, waiting for more stable economic signals.

4. Global trade volumes are falling.

Export-driven regions such as China, South Korea, and several EU economies are feeling the pressure from weaker demand.

Together, these forces paint a picture of an economy that is expanding, but at a slower and less stable pace.

Implications for Corporates, Investors, and Policymakers

Companies may need to prepare for slower revenue cycles, tighter margins, and more conservative capital planning. Many firms are expected to prioritize technology investments — especially AI and automation — that can boost efficiency despite limited growth environments.

Investors are likely to shift toward resilient, defensive sectors, including healthcare, essential consumer goods, infrastructure, and energy transition technologies. Long-duration assets may come under pressure until clarity emerges on central-bank rate paths.

For governments, the coming years will require a delicate balance between supporting growth and maintaining fiscal discipline. With central banks nearing their limits on monetary easing, more responsibility may fall on targeted fiscal interventions.

Stay informed with Daily Finance for sharp global finance reporting that cuts through noise and tracks real-world shifts shaping capital, energy, and commodity markets.