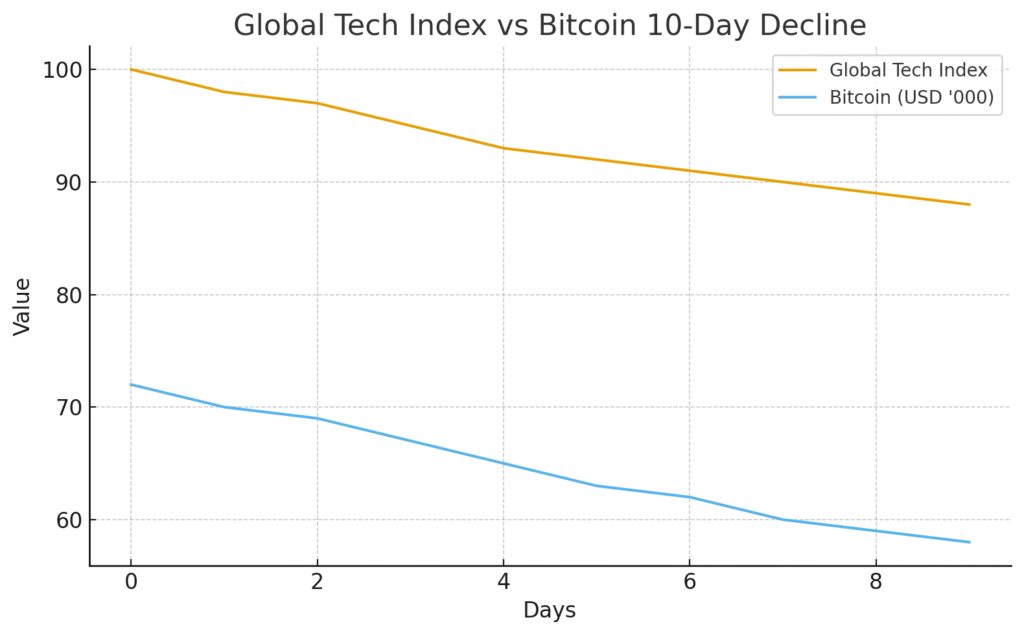

Global markets are experiencing a fresh wave of turbulence this week as concerns over an emerging AI bubble send shockwaves across equities and crypto. Investors who spent much of the year piling into tech are beginning to feel the weight of overheated sentiment. And with Bitcoin dropping to a seven-month low, the anxiety is cascading across almost every risk asset.

AI Euphoria Begins to Cool as Valuation Fears Intensify

The shift is sudden but not entirely unexpected. For nearly two years, heavy capital inflows into AI infrastructure created record-high valuations for chipmakers and cloud providers. The enthusiasm was powerful, often irrational, and almost immune to weak macro indicators. Now even mild signals that AI spending may be peaking are enough to spark aggressive selloffs.

Tech Markets in the US and Asia Take the Biggest Hit

Global indices have been reflecting this tension. Tech-heavy markets in the United States and Asia recorded broad declines as traders pulled back from high-multiple stocks. Analysts note that investors are reassessing whether the current pace of AI investments is sustainable. Some are drawing parallels to the early 2000s dot-com era, a time when hype pushed valuations far beyond fundamentals.

Bitcoin’s Seven-Month Low Signals Rising Liquidity Stress

Bitcoin’s fall adds another layer of pressure. Dropping to its lowest point in seven months, the world’s largest cryptocurrency shows how quickly sentiment shifts when global liquidity tightens. Crypto markets, often a mirror of tech-sector volatility, are responding sharply to the AI-driven market turbulence.

Investors Confront the Reality of Slowing AI Spending

At the core of current volatility is a simple concern: valuation discomfort. Some large enterprises have reportedly paused or slowed AI infrastructure spending, raising fears that early 2025 earnings may fail to meet expectations. Even if temporary, such signals shift global risk appetite fast.

Risk Sentiment Weakens Despite Strong Long-Term AI Fundamentals

From a macro perspective, the downturn isn’t tied to collapsing fundamentals. Instead, it’s driven by the volatility of expectations. Central banks remain conservative, and geopolitical tensions continue to hover. Combined with profit-taking behavior after a year of oversized gains, the drop becomes easier to rationalize.

Still, long-term optimism for AI remains. Analysts argue that short-term corrections prevent unhealthy overheating and ultimately support healthier growth cycles.

Crypto Traders Brace for Institutional Dip-Buying Opportunities

For Bitcoin, analysts believe the decline could trigger institutional buying at favorable entry points. ETF inflows, regulatory updates, and liquidity cycles remain the biggest drivers of long-term crypto performance. This week’s drop, though sharp, fits within Bitcoin’s historical volatility norms.

What Traders Will Watch Next

Looking ahead, all eyes are on corporate earnings releases, cloud spending guidance, chip supply updates, and AI capex disclosures. Strong confirmations could quickly reverse the current downturn. Weak numbers, however, may amplify caution across equities and crypto.

For now, markets are adjusting. Investors are recalibrating. And the world is watching whether this becomes a temporary correction or an early pressure test for the AI boom.

Most Asked Questions

1. Why are global markets falling?

Because AI spending concerns are fueling valuation stress across tech.

2. Why did Bitcoin drop to a seven-month low?

Crypto is mirroring tech volatility amid tightening liquidity.

3. Is an AI bubble forming?

No official signs, but investor behavior hints at early caution.

4. Will tech stocks recover?

A rebound depends on upcoming earnings and cloud spending forecasts.

5. Should investors worry about long-term risks?

Most analysts still argue AI fundamentals remain strong

RELATED POST