Japan’s economy is teetering on the edge as a fresh diplomatic spat with China threatens to erode one of its most critical growth drivers: tourism. With Chinese visitors accounting for nearly a quarter of all foreign arrivals in 2025, the newly issued travel advisory could slash as much as $13 billion in tourism revenue, analysts warn.

The move comes amid an already fragile economic recovery, with Japan’s Q3 GDP contracting 0.4% sequentially the first decline in six quarters and global investors watching closely for ripple effects across Asian financial markets.

Dynamic Body Content

Historic Context & Precedents

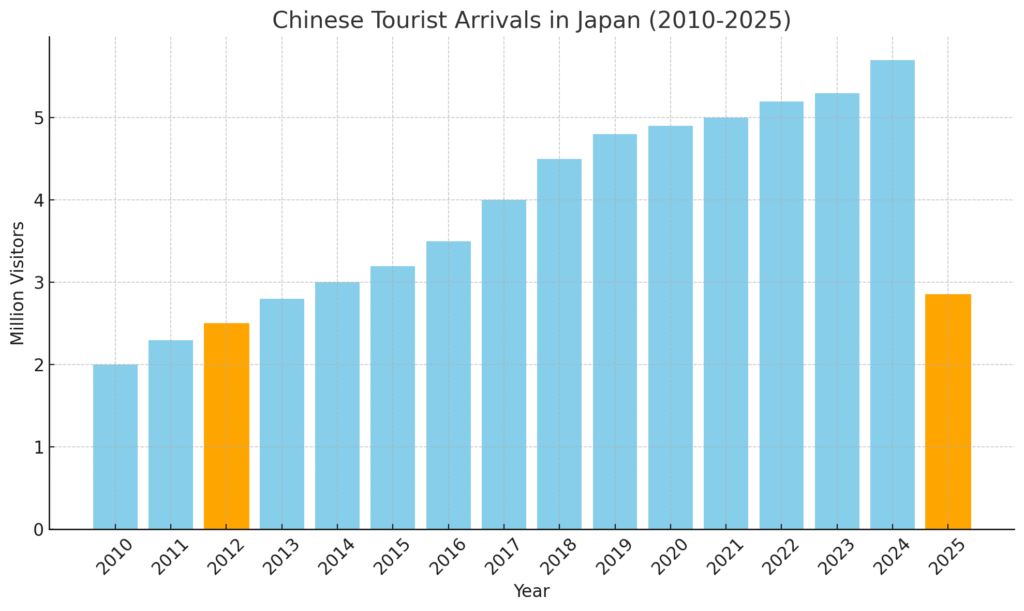

Past diplomatic disputes have shown how geopolitics can directly impact Japan’s economy. The 2012 Senkaku-Diaoyu dispute caused an 8% drop in Chinese tourists, hitting tourism-dependent sectors like airlines, hotels, and retail. Similarly, South Korea’s 2016 THAAD incident triggered a “soft ban” from China, disrupting trade and entertainment industries. Experts caution that history could repeat itself if tensions persist.

Current Developments

- Diplomatic Trigger: Japanese Prime Minister Sanae Takaichi’s comments on Taiwan prompted China to advise against travel to Japan.

- Tourism Impact: Mainland Chinese visitors, roughly 5.7 million this year, represent 23% of foreign tourists. A halving of arrivals could reduce GDP growth by 0.2 percentage points.

- Stock Market Reaction: Tourism-exposed stocks have already taken a hit, with investors wary of prolonged tensions.

Micro-analysis: Japan’s economy relies on tourism to boost domestic consumption, and even minor declines can reverberate through retail, hospitality, and transportation sectors.

Here’s Chart 1: Chinese Tourist Arrivals in Japan (2010–2025).

- Orange bars highlight key years: 2012 (Senkaku dispute) and 2025 (current year, projected drop if travel ban persists).

- Visitors are in millions, showing both historical trends and potential future decline.

Micro-insight: The current diplomatic spat could extend for months, and with Japanese tourism already a fragile pillar of economic recovery, the stakes are high.

Japan faces a critical test of economic resilience. With tourism revenue poised to drop dramatically, the ripple effects could touch every corner of the economy from hotels to retail to transportation and send cautious signals across Asian financial markets. Historical precedents remind investors and policymakers alike: geopolitical tensions are not just political they are economic shocks waiting to unfold.

Don’t miss critical finance insights that impact your business and investments. Follow Daily Finance for real-time updates, expert analysis, and market trends that matter