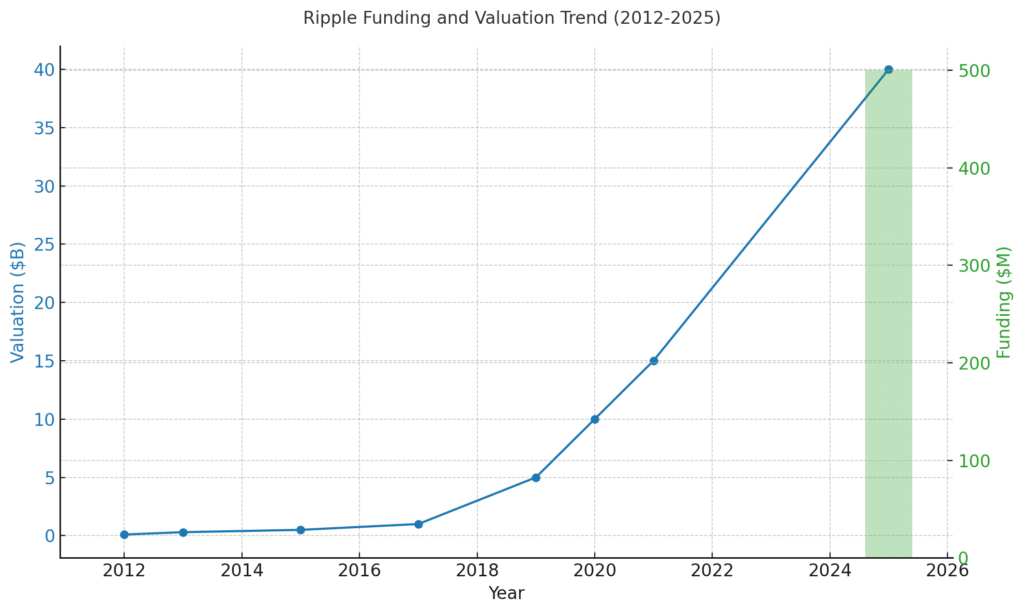

Breaking News: Ripple Secures $500 Million at $40 Billion Valuation

Ripple, the enterprise-focused fintech and blockchain company, announced a $500 million funding round led by Fortress and Citadel Securities, propelling its valuation to an impressive $40 billion. This milestone underscores continued institutional confidence in Ripple’s enterprise-grade crypto solutions, including its blockchain-powered payments network and token infrastructure.

The funding aims to accelerate product development, expand enterprise adoption of Ripple’s digital asset solutions, and solidify its positioning in global financial markets.

Why Ripple’s Growth Matters

Ripple’s latest valuation highlights a broader trend: institutional investors are increasingly backing blockchain infrastructure over speculative retail crypto. Key implications include:

- Enterprise adoption acceleration: Banks and payment providers are expected to integrate RippleNet and XRP liquidity solutions more extensively.

- Market confidence: Large-scale investment from Fortress and Citadel signals trust in Ripple’s technology, governance, and revenue model.

- Alternative finance positioning: Ripple is bridging traditional finance and crypto markets, offering both liquidity solutions and regulatory compliance.

Investor Insight: Early movers in Ripple’s enterprise ecosystem may see significant upside, while monitoring regulatory frameworks remains crucial.

Ripple’s Impact on Crypto and Payments

With global cross-border payments increasingly digital, Ripple’s technology addresses real pain points: speed, cost, and transparency. Compared to traditional banking rails, Ripple’s solutions reduce transaction times from days to seconds and lower costs dramatically.

Investor Perspective: Adoption of enterprise-grade crypto solutions suggests institutional portfolios might shift towards infrastructure tokens like XRP, highlighting a diversification opportunity beyond Bitcoin and Ethereum.

Strategic Partnerships Fuel Expansion

Ripple has previously partnered with dozens of financial institutions worldwide, and this funding is expected to deepen those collaborations. Key objectives:

- Banks & payment providers: Scale usage of RippleNet and XRP for cross-border settlements.

- Regulatory alignment: Continue working closely with regulators to ensure compliance and broader adoption.

- Tech innovation: Expand blockchain infrastructure capabilities for institutional-grade applications.

From an Investor’s Point of View

- Opportunities: Institutional-grade crypto exposure, early participation in enterprise blockchain adoption, portfolio diversification.

- Risks: Regulatory scrutiny in key markets (US SEC), volatility of underlying token assets, competition from other fintech/blockchain platforms.

- Signals to Monitor: New enterprise partnerships, regulatory approvals, platform adoption rates, and liquidity volumes.

FAQs

Q1. What is Ripple and how does it differ from Bitcoin?

Ripple focuses on enterprise blockchain solutions for cross-border payments, whereas Bitcoin is primarily a decentralized digital currency.

Q2. Who invested in Ripple’s latest funding round?

The round was led by Fortress and Citadel Securities, with participation from other institutional investors.

Q3. How will the $500M funding be used?

Funds will accelerate product development, expand enterprise adoption, and strengthen Ripple’s infrastructure and regulatory compliance initiatives.

Q4. Is Ripple a safe investment for crypto portfolios?

While Ripple has institutional backing and enterprise utility, investors should consider regulatory risks and token market volatility.

Q5. What does this valuation mean for the broader crypto market?

A $40B valuation for Ripple signals strong institutional confidence in blockchain infrastructure, which could shift investment focus toward enterprise-focused crypto solutions.

Stay ahead in the world of startups and finance — follow Daily Finance for daily updates on breaking finance news, market trends, and startup insights