Bitcoin Price Drop 2025: What Happened

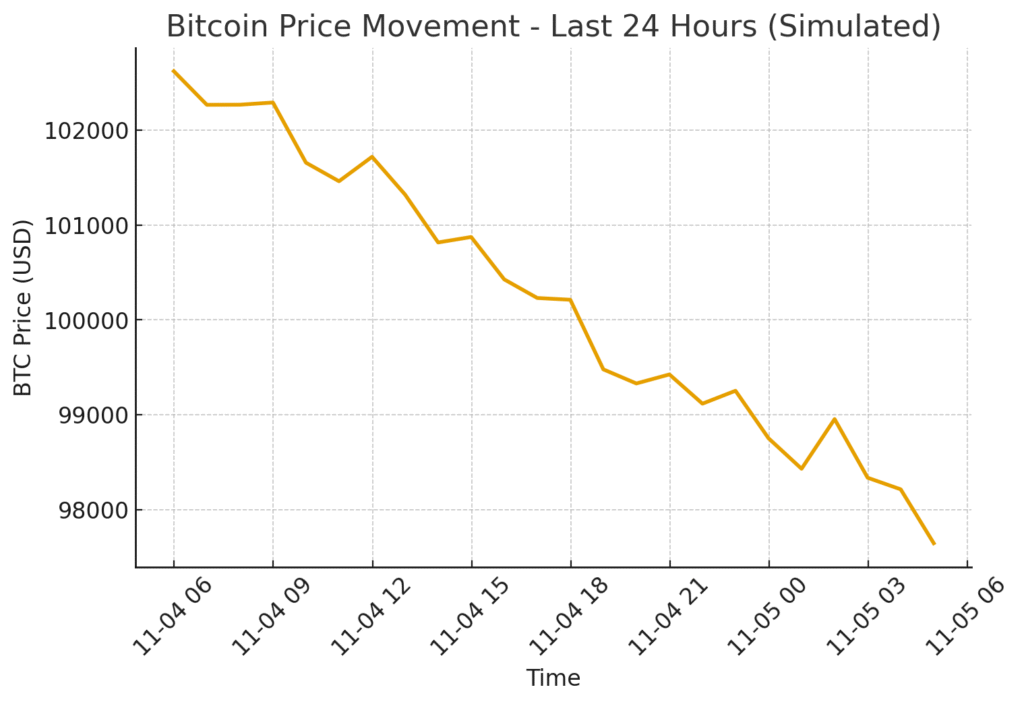

[Updated: 2025-11-05 09:30 IST] — Bitcoin rolled over overnight, slipping below a critical support level as a wave of forced liquidations rippled through futures markets. Traders reported cascading stop-losses that amplified selling pressure across major exchanges.

Price action: Bitcoin fell from about $102,500 to trade near $97,800 in the Asian session, representing a loss of roughly 4.5 percent in under six hours. On-chain data and derivatives platforms show more than $1.1 billion in long liquidations within the last 24 hours. The sudden unwind pushed volatility higher across the crypto complex, with Ether and major altcoins following lower.

Why it matters: Rapid liquidation events often trigger short-term panic and elevated trading volumes. For institutional players and corporate treasuries watching crypto allocations, such spikes underline the risks of concentrated leverage and thin liquidity during stress windows.

Market reaction:

• Spot exchanges saw widened bid/ask spreads and short-term funding spikes on perpetual swaps.

• Option markets priced higher implied volatility for the next 30 days.

• Stablecoin volumes increased as traders rotated to fiat-pegged liquidity.

The dramatic bitcoin price drop 2025 stunned global traders as markets saw nearly $1.2 billion in forced long liquidations in less than 24 hours. Bitcoin slipped from the $102,000 zone to $97,000, shaking institutional traders and retail investors alike.

Crypto exchanges reported an accelerated unwinding process, and futures platforms triggered cascading liquidations. That sudden movement reinforces one lesson: leverage cuts both ways.

This latest crypto liquidation spike shows how fast sentiment can flip when automated trading meets macro fear.

Why a Crypto Liquidation Spike Matters

A liquidation wave signals imbalance. When long positions unwind at scale, it means traders did not anticipate this level of volatility.

Market depth thinned. Liquidity providers reset bids. Funding rates moved sharply. The ecosystem absorbed shock, but not without pain.

For new entrants, this is a reminder that crypto markets are powerful and unforgiving during stress cycles.

Institutional Crypto Adoption 2025 Trends

Despite price swings, institutional crypto adoption 2025 continues shaping this asset class. Banks, regulated custodians, and fintech platforms are expanding crypto services.

Licensing frameworks in Singapore, the UAE, Europe, and India are driving safer participation. Yet, strict compliance rules can trigger synchronized risk-off behaviour.

This is the balancing act. Institutions stabilise crypto long-term, but create short-term feedback loops during high-volatility windows.

Market Sentiment and Trading Behaviour

When the bitcoin price drop 2025 hit, retail accounts rushed to stablecoins. Futures traders reduced leverage. Long-term holders stayed patient.

Smart capital never panics in a noise cycle. Volatility is a feature, not a flaw.

Money flows prove it: institutional desks paused, not exited. Their playbook is strategic accumulation when fear peaks.

Future Outlook

This correction is a reminder that bitcoin will keep testing conviction. Yet, each pullback historically sets a stronger foundation for long-term growth.

Investors watching this market cycle should consider diversification, custody security, and risk-managed exposure.

Regulated digital asset frameworks will keep expanding. Crypto is not going backward. It is maturing.

FAQs

What caused the bitcoin price drop 2025?

A sudden crypto liquidation spike triggered cascading sell orders on futures markets.

Is this a long-term trend?

No. Long-term institutional participation remains intact despite short-term volatility.

Should investors panic?

Market history suggests disciplined investors benefit from corrections rather than reacting emotionally.